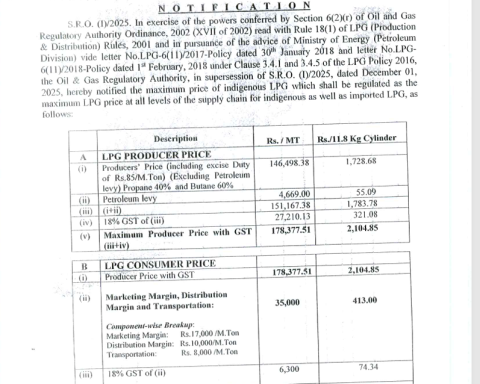

The Federal Board of Revenue has failed to implement Islamabad High Court’s (IHC) key directive for the implementation of an automated income tax refund system.

Presently, Inland Revenue’s field formations are delaying refunds in the name of withholding tax verifications and other excuses.

IHC order, aimed at reducing taxpayer interaction with tax officials and streamlining the refund process, has seen no significant progress despite a considerable passage of time. A report titled Findings and Recommendations of Committee for Effective Enforcement of Section 170A of the Income Tax Ordinance 2001 was submitted to the IHC, outlining a comprehensive plan for implementation but all in vain.

When contacted tax lawyer Waheed Shahzad Butt, representing the case confirmed that the FBR has failed to act on the recommendations despite assurances from its Member (Policy). Butt expressed concern over the FBR’s inaction, particularly given the government’s broader push for digitalisation in tax administration.

He highlighted that failure to implement the automated refund system not only hampers transparency but also raises doubts about the FBR’s commitment to efficiency and judicial compliance. Field formations continue to play a hide-and-seek game with taxpayers under the pretext of withholding tax verification, even though every single penny is directly verifiable from FBR’s own system “ITMS”.

Read More: Former US President Honoured With Emmy for Netflix Series

Such deliberate obstruction not only reflects professional inefficiency but also exposes the rogue mindset of elements within the department who are bent upon tarnishing the image of FBR and its Chairman. Unless strict disciplinary proceedings are initiated against these delinquent officers, this culture of maladministration will persist: Waheed added.

“ Field formations are behaving like foreign rulers when it comes to returning taxpayers’ money in the shape of refunds and continue to play a hide-and-seek game with taxpayers under the pretext of withholding tax verification”, he accused.

FBR is yet to take concrete steps to ensure enforcement of the IHC order. The continuation of this attitude amounts to defiance of judicial directives and is a serious blow to the credibility of the institution. In its order, the IHC noted that the FBR had committed to implementing the recommendations under a proposed $25 million loan from the World Bank. The court observed that while the petition’s objective appeared to have been met in principle, the petitioner retained the right to approach the court again if the recommendations were not enforced.

Despite the clear judicial directive, the FBR’s delay in executing the automation plan continues to impede progress, leaving taxpayers waiting for reforms that could enhance efficiency and transparency in the tax refund process.